After months of intense speculation and discussion, China finally yielded to global pressure and let the Yuan appreciate, albeit by a marginal 2% from its decade long peg to the dollar of 8.28 to the current 8.11. While the rate of appreciation is not significant, it assumes importance in the sense that it signals possibilities of a further appreciation in the pegged currency. The Chinese have also indicated that the Yuan will now be pegged to a basket of currencies and not just the dollar. In this write-up, we will take a look at the global implications and what this means for India.

Global implications

The revaluation impact will be beneficial to the Asian currencies in the sense that these Asian nations will now be willing to let their respective currencies strengthen, with China having finally initiated the move. Japan will also stand to benefit as Japan's exports make up 15% of China's imports. Overall, it will mean that Asian exports will now be more competitive. The US had been consistently reiterating the fact that the Chinese currency was undervalued, consequently hurting the US exports. The US is already facing the problem of swelling twin deficits, which was the leading cause of the dollar's huge depreciation against the global currencies towards the end of 2004. Therefore with this latest move, the US is likely to ease the pressure on the Chinese government to a certain extent.

Indian implications

RBI governor, Y.V Reddy had in an interview mentioned that a revaluation of the yuan was unlikely to have an adverse impact on India's economy and might even help trade competitiveness. It must be noted that the Indian currencies as well as other major Asian currencies were losing out on the exports front as the decade-old Chinese peg led to cheaper exports from the Chinese mainland. The rupee has been on an appreciating trend since the end of 2004, chiefly driven by FII inflows and even at times influenced by the rise of the global currencies against the dollar. However, RBI intervention kept the rupee from appreciating at a steep pace. Therefore, consequent to the Yuan revaluation, appreciation of the rupee is not likely to have an adverse impact on India's exports. However, it will mount the pressure on the RBI to intervene in case of a very fast rise in the rupee.

Sectoral impactOil:In the recent months, oil prices have skyrocketed touching the US$ 60 per barrel. Since, India imports around 70% of the oil that it consumes, any appreciation in the Indian currency is beneficial to the oil firms, which will now have to buy dollars at a cheaper rate to import oil.

Software:

Since the Chinese currency has appreciated by only 2%, software firms do not expect the revaluation and consequently a stronger rupee to adversely impact their business. However, it must be noted that severity of the impact will depend on the extent of the exposures and how well the software companies have hedged the same.

commodities: A stronger Yuan would mean that, for China, imports will be cheaper. This means that the demand for steel and other commodities will be on the rise. However, considering the fact that China is already facing a situation of a supply overhang and is in fact a net exporter of steel, textiles, chemicals and other commodities, it really remains to be seen how the Indian commodity companies are likely to be benefited by the same.

Our viewIt must be noted that the steep appreciation in the major currencies against the dollar after the Yuan revaluation was a knee-jerk reaction influenced more by the surprising element of the move rather than the scale. However, since then the dollar has recovered its losses as the focus once again shifts to the economic fundamentals. While the latest move by China is not likely to significantly impact India, it remains to be seen whether China will go in for a further revaluation in the future and the extent of the same. However irrespective of the Yuan revaluation, if India Inc. continues to show strong growth and FIIs continue to pump in money into the economy, rupee is poised to get stronger. Therefore, it all boils down to what risk management measures, companies are adopting to hedge against the same.

Wednesday, July 27, 2005

Tuesday, July 26, 2005

Astrology prediction of market

SENSEX PREDICTIONS

WEEK 29

25/07/05(Monday)

Market may not be so good and might have a volatile nature

Sensex is expected to open on the upper side or near to the previous day’s close

After 10:13 the market may tend to weaken

After 14:17 it is likely to become stable

Sensex is likely to close on the same level as at 14:17

26/07/05(Tuesday)

The market is likely to have a phase of recession

Sensex is expected to open on the lower side of the flat line

After 10:50 the market is likely to go down

After 13:03 there may be an improvement in the market trend

Sensex is expected to close on the upper side or near to the level as at 13:03

27/07/05(Wednesday)

The market is expected to have many uncertainties today

The market is likely to see big ups and downs

Sensex is expected to open near or on the upper side of the previous close

After 12:30 market trend is likely to improve

Sensex may close near to or on the upper side of the opening level

28/07/05(Thursday)

The market is likely to have a strong undertone nature for the day

Sensex is expected to open on the upper side or near to the previous close

After 12:42 there may be an improvement in the market trend

There is a chance for the Sensex to close on the upper side of the opening level

29/07/05(Friday)

The market is expected to rise due to some good indications

Sensex is likely to open lower or near to the previous close

After 10:35 the market trend is likely to improve

After 13:37 there may be further improvements

Sensex is expected to close on the upper side of the level as at 13:37

WEEK 29

25/07/05(Monday)

Market may not be so good and might have a volatile nature

Sensex is expected to open on the upper side or near to the previous day’s close

After 10:13 the market may tend to weaken

After 14:17 it is likely to become stable

Sensex is likely to close on the same level as at 14:17

26/07/05(Tuesday)

The market is likely to have a phase of recession

Sensex is expected to open on the lower side of the flat line

After 10:50 the market is likely to go down

After 13:03 there may be an improvement in the market trend

Sensex is expected to close on the upper side or near to the level as at 13:03

27/07/05(Wednesday)

The market is expected to have many uncertainties today

The market is likely to see big ups and downs

Sensex is expected to open near or on the upper side of the previous close

After 12:30 market trend is likely to improve

Sensex may close near to or on the upper side of the opening level

28/07/05(Thursday)

The market is likely to have a strong undertone nature for the day

Sensex is expected to open on the upper side or near to the previous close

After 12:42 there may be an improvement in the market trend

There is a chance for the Sensex to close on the upper side of the opening level

29/07/05(Friday)

The market is expected to rise due to some good indications

Sensex is likely to open lower or near to the previous close

After 10:35 the market trend is likely to improve

After 13:37 there may be further improvements

Sensex is expected to close on the upper side of the level as at 13:37

Monday, July 25, 2005

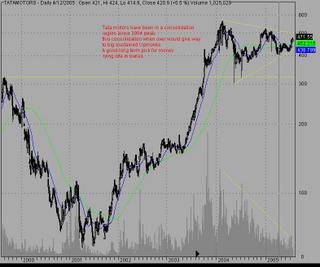

tata motors and maruti

Sunday, July 24, 2005

Stay Aback, equity is not for all !!!!!!!!!!!!

It is important to answer the following questions before you begin to invest any of your money. The answers to these questions will help guide you to when, what, where, and how much to invest. Do not skip these questions and make sure you write it all down. You will need to look over and re-examine your answers often.

1. Set clear goals and write them down.

Develop financial goals for 1 year, 5 years, 10 years, and long term. It is extremely important that all of your short-term goals help you to reach your long-term goals. Any good plan must be realistic. In the area of investments, the rewards can be great - but only when they are done one step at a time. Therefore, once you have conducted sufficient research into the opportunities available to you, go back and fine tune your goals. Once you have done this, make sure you write them down and keep them in a place that you can easily refer to them.Now that you have goals, it is time to take your first step to make them real and attainable. As applicable, share your goals with someone in your family - those who will be most affected by these goals. They must be involved because they are going to be your support and motivation.

2. Create a finacial plan.

Next, you need to create a financial plan to reach your short-term goals. By reaching and accomplishing these short-term goals, the long-term goals will be achieved. You need to decide how much time, energy, and money you are going to need to invest in order to accomplish your short-term goals. Some of the questions you must answer are: "How much time can I put into my investments?""What kind of risk am I willing take?" and, "How soon am I going to be ready to start?" Use all of the resources you can find to answer these questions. You will find some of my own ideas as well as other ideas I have found posted in the "Articles" section of The Savvy Investor. Do not be afraid to take the time needed to answer these questions before you actually begin to invest. Lastly, stay the course once you begin.

3. Establish a spending plan with the actual amount you have to invest.

The prime force behind your investment opportunities will be the amount of money you have to invest. This is your investment life line; do not over extend it. But, also, do not be afraid to invest enough to reach your goals. Take the time to create a budget by tracking your current spending - this should be done for at least a few months. However if you have the records, you can go back through the past few months to track where you spent your money.Next, figure out how much per month you can invest without it affecting those things you need. Do not over-extend how much you can invest. And, definitely, do NOT borrow money to invest; this can make all of your hard work turn out for naught. In fact, you should make it a priority to pay off any high-interest debt you may have. It is financial suicide to let high interest accumulate, while you put your money into investments with lower returns. Finally, refrain from taking on any new debt.

4. Educate yourself continuously.

Remember that the three above areas assume that you are educating yourself. In order for you to be successful in your investments, you need knowledge. The above areas can only be accomplished with the correct amount of time spent to learn about yourself, investment risks, investment rewards, investment strategies, and many other aspects of investment. Use all of the resources available to you to learn which market is best for you - and then all of the concepts and strategies of that particular market - before you begin. There are many articles and links on The Savvy Investor but do not hesitate to find other resources such as books, magazines, and financial journals to help you out.In closing, it is better to spend a little money on education than lose a lot of money by jumping in blind.

Happy reading !!!!!!!!!!!!

1. Set clear goals and write them down.

Develop financial goals for 1 year, 5 years, 10 years, and long term. It is extremely important that all of your short-term goals help you to reach your long-term goals. Any good plan must be realistic. In the area of investments, the rewards can be great - but only when they are done one step at a time. Therefore, once you have conducted sufficient research into the opportunities available to you, go back and fine tune your goals. Once you have done this, make sure you write them down and keep them in a place that you can easily refer to them.Now that you have goals, it is time to take your first step to make them real and attainable. As applicable, share your goals with someone in your family - those who will be most affected by these goals. They must be involved because they are going to be your support and motivation.

2. Create a finacial plan.

Next, you need to create a financial plan to reach your short-term goals. By reaching and accomplishing these short-term goals, the long-term goals will be achieved. You need to decide how much time, energy, and money you are going to need to invest in order to accomplish your short-term goals. Some of the questions you must answer are: "How much time can I put into my investments?""What kind of risk am I willing take?" and, "How soon am I going to be ready to start?" Use all of the resources you can find to answer these questions. You will find some of my own ideas as well as other ideas I have found posted in the "Articles" section of The Savvy Investor. Do not be afraid to take the time needed to answer these questions before you actually begin to invest. Lastly, stay the course once you begin.

3. Establish a spending plan with the actual amount you have to invest.

The prime force behind your investment opportunities will be the amount of money you have to invest. This is your investment life line; do not over extend it. But, also, do not be afraid to invest enough to reach your goals. Take the time to create a budget by tracking your current spending - this should be done for at least a few months. However if you have the records, you can go back through the past few months to track where you spent your money.Next, figure out how much per month you can invest without it affecting those things you need. Do not over-extend how much you can invest. And, definitely, do NOT borrow money to invest; this can make all of your hard work turn out for naught. In fact, you should make it a priority to pay off any high-interest debt you may have. It is financial suicide to let high interest accumulate, while you put your money into investments with lower returns. Finally, refrain from taking on any new debt.

4. Educate yourself continuously.

Remember that the three above areas assume that you are educating yourself. In order for you to be successful in your investments, you need knowledge. The above areas can only be accomplished with the correct amount of time spent to learn about yourself, investment risks, investment rewards, investment strategies, and many other aspects of investment. Use all of the resources available to you to learn which market is best for you - and then all of the concepts and strategies of that particular market - before you begin. There are many articles and links on The Savvy Investor but do not hesitate to find other resources such as books, magazines, and financial journals to help you out.In closing, it is better to spend a little money on education than lose a lot of money by jumping in blind.

Happy reading !!!!!!!!!!!!

Saturday, July 23, 2005

Markets: What's the buzzword?

Markets: What's the buzzword?

The Indian stockmarkets are in the grip of a strong bull run. This is evident from the fact that the indices have been making new highs almost every day now and stocks, big and small, have been flying around, making and breaking records along the way as they move into the so called 'uncharted' territories. As the Sensex seems determined to test the 'next' highs, there are already whispers floating in the market about the magic 8,000 levels not being far away. 'Bulk deals', 'record volumes', 'exponential bottomline growth' and 'turnaround story' have become the buzzwords in the market. The theory of investing has unfortunately moved away from 'fundamentals' and 'rationality' to the newly found USPs (unique selling propositions) mentioned above. But, one needs to ponder, are these really the 'true' reasons that one should consider while investing?

Before we go onto throw some light on the buzzwords, which re-surface every time the markets are witnessing a bull run, let us take a look at the kind of 'unsustainable' euphoria that has already built up and is being witnessed currently on the bourses. Below provided are some links to pages, which show the top gainers across various periods on the BSE with most of these stocks belonging to the B2 and the groups below that.

BSE gainers: Over the week, Over the month, Over the year (this is scary!)

Now let us consider some of the buzzwords in a little detail.

Bulk deals: This is the term used to describe the event when a substantial amount of equity of a company changes hands on the bourses i.e. one party buys a significant chunk of the free floating stock available in the market from another party. The amount of equity (in nos.) could be anything as far as it is significant number of shares that are traded (generally higher) as compared to the historical average. However, while we do not question the credibility of all the bulk deals that place on the exchanges, a quick glance through leading newspapers would indicate a strange pattern. This is of the 'buyer' and the 'seller' being the same/related party/investor and you don't need much IQ to come to the conclusion that the two of them are linked. This basically implies mere 'changing of pockets in the same shirt' and investors need to be really careful of such developments, as they artificially inflate the trading volumes.

Record volumes: While one of the reasons for exorbitantly high trading volumes is the act of bulk deals, investors must note that there is no shortage of traders/punters in the market who merely take advantage of the euphoria being built around a stock. These 'opportunists' consistently get in and out of the stock in the most irresponsible manner and have no real intentions of actually taking delivery of the stock. And this is precisely because they themselves do not know what will be the future of the stock when the markets re-open for trading the following day. Thus, these volumes are basically just froth and have no real connection to the actual fundamentals of the company.

Delivery ratio: A seemingly decent parameter to track whether there is actually some serious buying taking place in a particular stock is the delivery ratio of the stock. One shouldn't be surprised to know that the recent darlings of the bourses i.e. ITI, SRF, Titan, VSNL and Aptech have consistently been registering very low delivery statistics (in the region of 2% to 20%). While the counter argument here could be that since the traded volumes in these stocks are now significantly higher and the actually deliveries would tend to be lower, we would advise investors to remain cautious of the additional 'froth' (non-delivery based volumes) that is present in these stocks.

However, we must mention here that while most stocks, which are traded in the futures and options (F&O) market, would tend to have lower volumes for various reasons, we would advise investors to, nonetheless, remain cautious. Further, it must be noted that since the 'T' (trade-to-trade) group of stocks are compulsorily marked for delivery, this should not be implied as these are fundamentally sound companies since the delivery is 100%. Rather one should wonder why were these stocks placed in the trade-to-trade category in the first place? And the reasons could be many - no timely filing of quarterly results, to curb speculative activity in these stocks, non-compliance of various stock exchange rules and regulations, and the list goes on!

To conclude, while this article was not aimed at sounding negative on the markets, it was merely an attempt to bring to the forefront the various terminologies/techniques used by market makers to generate higher profits (largely at the expense of the retail investor) and by brokers to convince their clients and generate some additional brokerage. By the way, have you checked your broker's profit and loss account (if they are listed) and compared it to your percentage gains

The Indian stockmarkets are in the grip of a strong bull run. This is evident from the fact that the indices have been making new highs almost every day now and stocks, big and small, have been flying around, making and breaking records along the way as they move into the so called 'uncharted' territories. As the Sensex seems determined to test the 'next' highs, there are already whispers floating in the market about the magic 8,000 levels not being far away. 'Bulk deals', 'record volumes', 'exponential bottomline growth' and 'turnaround story' have become the buzzwords in the market. The theory of investing has unfortunately moved away from 'fundamentals' and 'rationality' to the newly found USPs (unique selling propositions) mentioned above. But, one needs to ponder, are these really the 'true' reasons that one should consider while investing?

Before we go onto throw some light on the buzzwords, which re-surface every time the markets are witnessing a bull run, let us take a look at the kind of 'unsustainable' euphoria that has already built up and is being witnessed currently on the bourses. Below provided are some links to pages, which show the top gainers across various periods on the BSE with most of these stocks belonging to the B2 and the groups below that.

BSE gainers: Over the week, Over the month, Over the year (this is scary!)

Now let us consider some of the buzzwords in a little detail.

Bulk deals: This is the term used to describe the event when a substantial amount of equity of a company changes hands on the bourses i.e. one party buys a significant chunk of the free floating stock available in the market from another party. The amount of equity (in nos.) could be anything as far as it is significant number of shares that are traded (generally higher) as compared to the historical average. However, while we do not question the credibility of all the bulk deals that place on the exchanges, a quick glance through leading newspapers would indicate a strange pattern. This is of the 'buyer' and the 'seller' being the same/related party/investor and you don't need much IQ to come to the conclusion that the two of them are linked. This basically implies mere 'changing of pockets in the same shirt' and investors need to be really careful of such developments, as they artificially inflate the trading volumes.

Record volumes: While one of the reasons for exorbitantly high trading volumes is the act of bulk deals, investors must note that there is no shortage of traders/punters in the market who merely take advantage of the euphoria being built around a stock. These 'opportunists' consistently get in and out of the stock in the most irresponsible manner and have no real intentions of actually taking delivery of the stock. And this is precisely because they themselves do not know what will be the future of the stock when the markets re-open for trading the following day. Thus, these volumes are basically just froth and have no real connection to the actual fundamentals of the company.

Delivery ratio: A seemingly decent parameter to track whether there is actually some serious buying taking place in a particular stock is the delivery ratio of the stock. One shouldn't be surprised to know that the recent darlings of the bourses i.e. ITI, SRF, Titan, VSNL and Aptech have consistently been registering very low delivery statistics (in the region of 2% to 20%). While the counter argument here could be that since the traded volumes in these stocks are now significantly higher and the actually deliveries would tend to be lower, we would advise investors to remain cautious of the additional 'froth' (non-delivery based volumes) that is present in these stocks.

However, we must mention here that while most stocks, which are traded in the futures and options (F&O) market, would tend to have lower volumes for various reasons, we would advise investors to, nonetheless, remain cautious. Further, it must be noted that since the 'T' (trade-to-trade) group of stocks are compulsorily marked for delivery, this should not be implied as these are fundamentally sound companies since the delivery is 100%. Rather one should wonder why were these stocks placed in the trade-to-trade category in the first place? And the reasons could be many - no timely filing of quarterly results, to curb speculative activity in these stocks, non-compliance of various stock exchange rules and regulations, and the list goes on!

To conclude, while this article was not aimed at sounding negative on the markets, it was merely an attempt to bring to the forefront the various terminologies/techniques used by market makers to generate higher profits (largely at the expense of the retail investor) and by brokers to convince their clients and generate some additional brokerage. By the way, have you checked your broker's profit and loss account (if they are listed) and compared it to your percentage gains

Subscribe to:

Posts (Atom)